Individuals Earning Purely Compensation Income (including Non-Business/NonProfession Related Income and Single Proprietors) can look forward to higher take-home pay in 2023.

This is per Republic Act (R.A.) No. 10963, otherwise known as the Tax Reform for Acceleration and Inclusion (TRAIN) Law, which took effect on January 1, 2018.

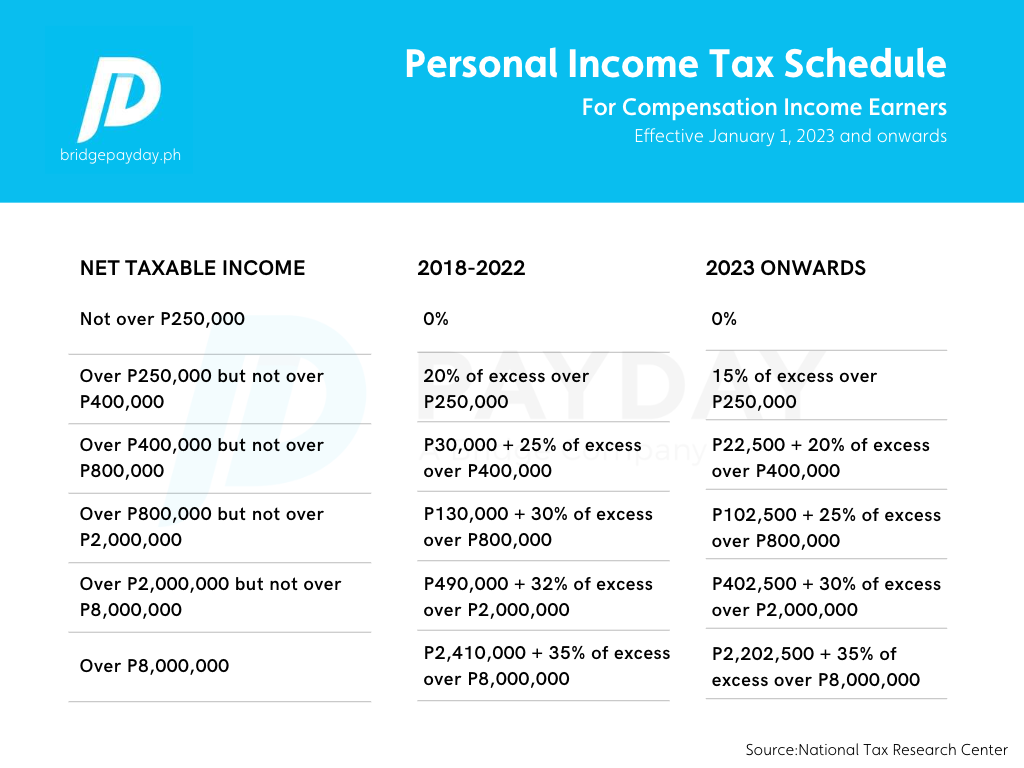

Under the TRAIN Law, starting January 1, 2023, those with annual taxable income below P 250,000.00 are still exempt from paying personal Income Tax, while the rest of taxpayers, except those with taxable income of more than P 8 Million, will have lower tax rates ranging from 15% to 30% by 2023. To maintain progressivity, the top individual taxpayers whose annual taxable income exceeds P 8 Million were imposed a higher tax rate of 35% from the previous 32%.

The income tax on the individual’s taxable income shall be computed based on the following schedules effective on January 1, 2023, and onwards:

Compared to the Income Tax rates imposed during the initial implementation of the TRAIN Law in 2018, the new annual Income Tax rates for Individuals significantly decreased by 5% for those with taxable income of more than ₱250,000.00 up to ₱2,000,000.00, while a 2% decrease in the tax rate was noted for those individuals with taxable income of more than ₱2,000,000.00 up to ₱8,000,000.00.

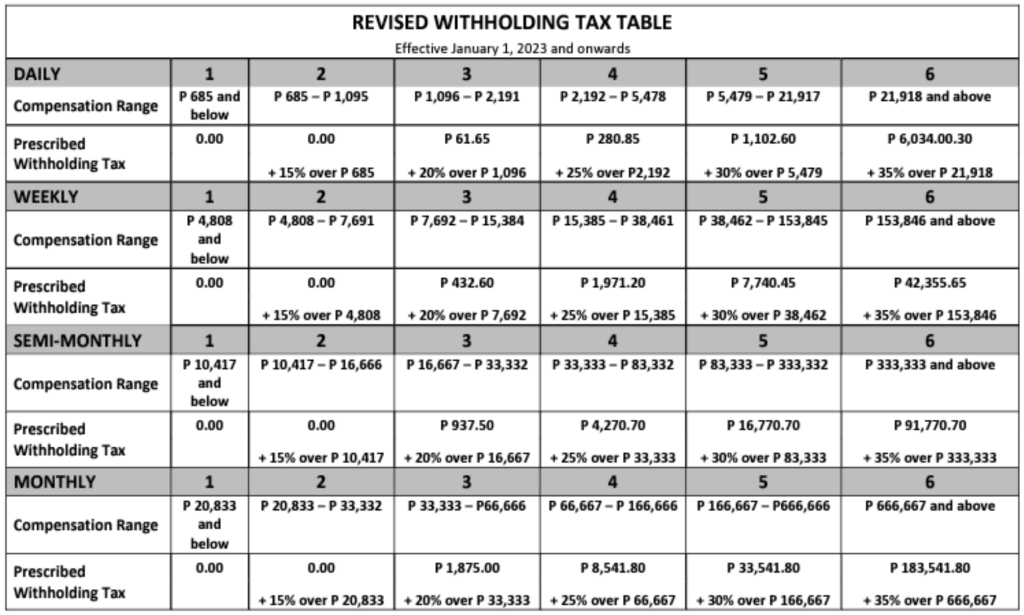

“With the said reduction in the annual Income Tax rates, Individuals Earning Purely Compensation Income will have lower withholding tax deductions from their monthly salary, thereby increasing their take-home pay,” said Commissioner Romeo D. Lumagui, Jr.

Effective January 1, 2023, and onwards, employers shall use the Revised Withholding Tax Table (as shown below) for the computation of Withholding Taxes on Compensation Income of their employees (as provided in Annex E of Revenue Regulations No. 11-2018).

Source: https://www.bir.gov.ph/images/bir_files/PR49DEC2322.pdf